About Us

Life Sciences

Life science is the branch of sciences concerned with all processes affecting living organisms

Structurally supported real estate

Ageing population

Life sciences field expanding - AI, quantum computing

Increasing government spending

AI accelerating discovery

Globally leading academic institutions

Demand for digital health

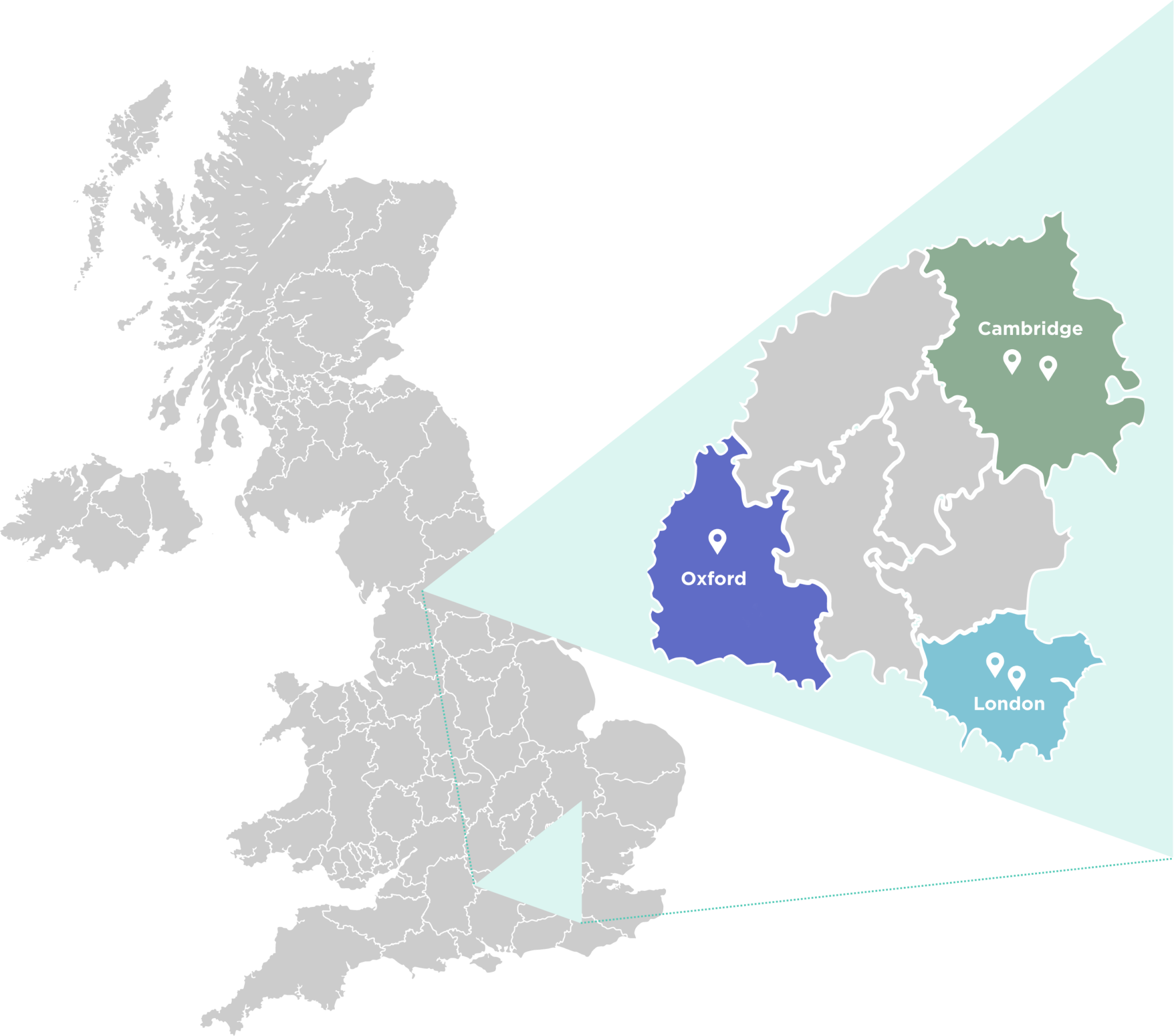

‘Genius Loci’, our priority

Most important science cluster in Europe – 6,850 life science businesses in the UK(1)

Global leader on VC funding per capita – Cambridge leads the ranking and London and Oxford sit within the top 5(2)

Lab availability low – 1.3% in Cambridge (3)

Supply shortage – 21m sq ft of new space required in the UK for life science over the next decade(2)

Take-up ahead of the five-year average – 1.3m sq ft recorded in the Golden Triangle from life science companies in 2023(4)

Strong lab rental growth forecasts – 4.3% p.a. in Cambridge and 3.0% p.a. in Oxford until 2029(5)

(1) UK Government Q4 2023

(2) Savills Q4 2022

(3) Cushman & Wakefield Q2 2024

(4) Savills Q4 2023

(5) Bidwells Q2 2024